53 points on 83% FG shooting, 32 rebounds, 14

assists, 11 steals, and 24 block shots

Officially, there has never been a quintuple

double achieved in the NBA nor ABA. Heck,

it’s even been over 25 years since the last quadruple double was recorded

(David Robinson – February 1994) and there has only been five such occurrences

of a quadruple double in all of NBA history (none in the ABA) – Nate Thurmond

(October ’74), Alvin Robertson (February ’86), Hakeem Olajuwon (twice in March

of 1990), and then Robinson’s in ‘94.

The official statistics collected on steals and blocked shots did not

begin to occur in the NBA until the 1973-’74 season. The ABA started their league in the autumn of

1967 and always did have the two stat categories in their official bookkeeping.

However, during the 1960’s and early 70’s in

the NBA, it was common during games for the play-by-play announcer or newspaper

journalist in attendance to keep a running tally of blocked shots and steals to

help describe the game. At the time, the

official game scorer or statistician kept record only on the traditional

categories: points, rebounds, assists, personal fouls, shot attempts (with

makes) and playing time. Since it was

the era of the big dominating centers like Bill Russel, Wilt Chamberlain, Walt

Bellamy, Nate Thurmond, and even the early days of Kareem Abdul-Jabbar, blocked

shots began to obtain significant air time with the play-by-play announcers

(and/or writers) as they used it to help differentiate the big man play. The significant All-Star backcourt players at

the time of Oscar Robertson, Rick Berry, Jerry West, Sam Jones, and Elgin

Baylor created a significant amount of opposing player turnovers and thus

announcers/writers found the category of steals valuable to help communicate

the talent and impactful influence of the smaller players on the court.

This brings us to March 18, 1968 and a

Philadelphia 76ers 158 to 128 win over the Los Angeles Lakers. Officially, Wilt Chamberlain’s performance in

leading his team to a fairly easy win at home was recorded as 53 points on (24

of 29 field goals – 82.8%), 32 rebounds, and 14 assists for a monster triple

double on 48 minutes (full game) of playing time. Unofficially, Wilt is said to also have

collected 11 steals and 24 blocked shots in this same game. Add it all together and it’s a quintuple

double! And, most would agree that it is

one insane single game performance.

https://fadeawayworld.net/2020/04/01/wilt-chamberlain-reportedly... https://www.basketball-reference.com/boxscores/196803180PHI.html

It would be very interesting to witness how

Wilt Chamberlain would be perceived throughout history if steals and blocked

shots were recorded during his entire playing career (probably even more

valuable would have been video footage of his games – it is estimated that only

1-2% of Wilt’s performances have video).

Mr. Chamberlain holds numerous single game, single season, and career

statistical records, including the most points in a single game (100), most

rebounds in a single game (55), and never fouling-out of a contest in his

career. After he was criticized in the

press for being too one-dimensional in the summer of ‘67, Wilt responded with

his play on the court. He concluded the

1967-68 season by winning his third straight and final league MVP award (4th

total) with tops in FG% (60%), total assists (702), rebounds (23.8/game), and

playing time (46.8 min/game)!

https://www.basketball-reference.com/players/c/chambwi01.html

What type of statistics do you keep track of

in your farm business? The ag-professionals

say we should track at minimum our cost of production per bushel (or 100 weight

or ton) in each crop, input costs per acre, field by field profitability, and

if we’re doing some variable rate applications, a zone cost analysis versus a

whole field or lump sum acre analysis.

The financial partners will desire evaluating more dynamic stats like working

capital, debt to asset ratio, return on assets, liquidity ratio, etc. Every farm manager will see more value in

certain financial numbers over others. At

the end of the day, the important thing is the consistent work being done to

keep all the business stakeholders informed so the ship stays pointed in the

right direction. Good luck!

Regional Weather

It should be a week of melting

and thawing conditions as most days are forecasted for high temps in the 40’s. Combine those temperatures with the relatively

light snow pack, and we should see very minimal snow in the fields after the

first week in March. These conditions

create very “lamb” like conditions for the first part of March. We’ll see if the lion rears its ugly head at

the end of the month!

I’ll count on your weather app

for the best guidance through the 7-8 day forecast, but looking beyond that,

I’ve found this site from National Oceanic Atmospheric Association (NOAA) to be

fairly reliable for a general 8-14 day outlook (next week).

https://www.cpc.ncep.noaa.gov/products/predictions/814day/index.php

For the second full week of March,

the forecast is to have greater potential for above average temperatures. Regarding the precipitation chances, they are

split as we go from east to west in our region - above average chances to the east

and below average chances to the west.

The NOAA

organization also provides three month outlooks. If we would like to get a general forecast

for the latter half of the upcoming spring season (April-May-June), it can be

seen here:

https://www.cpc.ncep.noaa.gov/products/predictions/long_range/seasonal.php?lead=2

This forecast

currently predicts above average chances on the temperature potential, along

with equal chances for precipitation in our region. Overall, if that holds true, we would welcome

the developments and hope to see a drift towards enhanced chances of

precipitation for the crops.

There is always risk of failure. Even though market prices are much stronger

currently then we have seen in the past several years, there is still work

remaining to build back additional equity into our businesses. Farm Progress had a good article reminding

farm managers to stay diligent at working on the business to faster achieve

your goals. A few good reminders:

·

Borrow and invest in things that have a strong

return on investment. If you have an

expensive hobby – you should play in that space with disposable cash

·

Continue to prioritize and implement your marketing

plan or strategy – these actions should have even greater rewards with

profitable commodity markets

·

Communication remains key. Work to keep all business partners on the

same page and the communication open.

Nothing breaks down a business more quickly than lack of communication

which quickly and easily moves to a lack of trust

·

Continue to have a reasonable, realistic, and

budgeted family living expense

·

Avoid spending large sums of money to completely

avoid taxes. Remember the old saying,

“nobody goes broke paying taxes”

·

Continue focusing on building a strong farm

business team – employees, business partners, family, outside business

relationships, etc.

https://www.farmprogress.com/commentary/why-farms-fail-even-good-times?...

Farm Inheritance and Estate Planning

It’s difficult to expand on this topic much as each farm operation is different in how they are planning on passing down the farm business to the next generation. However, I thought it was interesting to note that discussions are occurring at the federal level in basis point calculations. Stay in touch with your financial planner and/or tax accountant on how things are developing on this topic. Finding avenues through local connections on how you can potentially have your voice heard among the federal law makers is also a worthy investment of time.

Spring Wheat

Herbicide Options from Corteva®

For those of you with TruChoice™ dollars committed – thank you. I know many of you are on the ball and already have a plan placed together on where specifically you will spend those dollars. Others maybe shooting from the hip, so let’s review a couple simple, cost-effective, and solid weed killing solutions in the spring wheat crop for our TruChoice™ commitment.

WideARmatch™ – This pre-mix of Arylex™ active (halauxifen-methyl), Stinger™ (copyralid), and Starane™ (fluroxypyr), should be a big hit for growers in our region to provide some strong broadleaf control as well as keep us open for crop rotation flexibility. WideARmatch™ tank-mixed with 2.4-D will control all of our tough broadleaf weeds including – waterhemp, common lambsquarter, ragweed, and kochia. WideARmatch™ alone can be applied from 2-leaf to flag leaf emerged, but the 2.4-D will restrict application from full tiller to before jointing. If grass weed (wild oat and/or green/yellow foxtail) control is desired, tank-mix with Puma® or Axial®.

Pixxaro™ EC – If you are a little leery

of Stinger carryover into the following year’s crop of soybeans or dry beans

under drier conditions, you could move to Pixxaro™ EC. Pixxaro™ EC is a premix of Arylex™ active and

Starane®.

Bayer®

is bringing out Huskie® FX which adds Starane® to their mix. However, be a little concerned as they are

only adding a 2.9 oz/ac rate of Starane® in their Huskie® FX jug while Corteva®

brings a 5.0 to 5.1 oz/ac rate of Starane® in Pixxaro® EC and WideARmatch®

respectively.

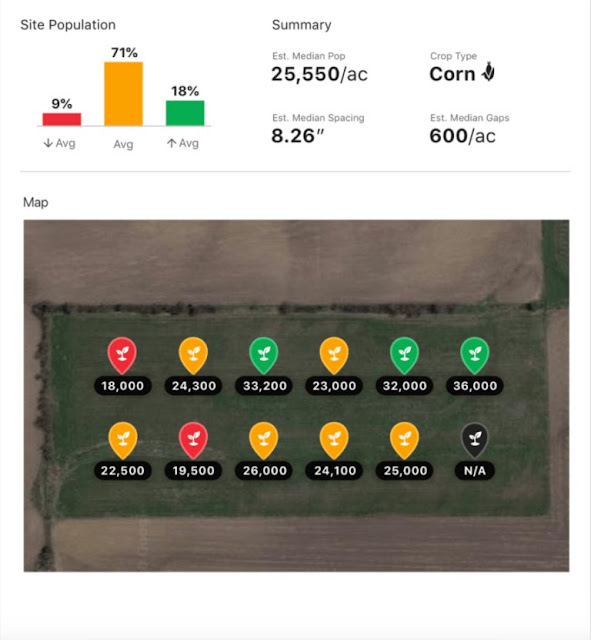

Product Spotlight: DroneDeploy’s Stand Assessment Software

DroneDeploy continues their march ahead to

maintain a leading edge as one of the world’s top software companies for

generating impactful data with drones or UAVs (unmanned aerial vehicles). Agriculture is a significant part of

DroneDeploy’s business, and thus they have recently announced bringing

capabilities to farms globally for assessing early crop stands (or plant

establishment). The announced

collaboration with Corteva Agriscience (developers of the Artificial

Intelligence software for crop establishment) will bring whole field stand

assessments to farm managers, consultants and other partners who see value in

accurately assessing whole fields for early performance of a crop and the

corresponding genetics.

Corteva has one of the world’s largest agricultural

UAV fleets with over 600 drones and is a very significant annual contributor to

DroneDeploy’s agricultural mapping volume (55 mil acres mapped in 2020 for

DroneDeploy). If you should have

concerns next spring with your stand establishment and contemplating replant,

please reach-out to discuss and we’ll make time to fly our drone(s) across your

fields. If you have a drone and are

looking for software to help make more impactful use out of it across the farm,

please visit the DroneDeploy website below.

https://www.dronedeploy.com/solutions/agriculture/ http://news.agropages.com/News/NewsDetail---38050.htm

China Continues with Strong Corn Import Volumes

China’s demand for corn remains robust as the

country is trying to rebuild its grain stock reserves amid high domestic prices

and growth in animal feed consumption.

S&P Global Platts Analytics estimates China to have a 30 mil MT

(1.18 bil bu) “structural deficit” for corn in the current marketing year due

to their high demand. In the 2019-20

marketing year, China only imported 7.6 mil MT of US corn and it is forecasted

that the current marketing year will see a 3 to 4-fold increase.

https://www.spglobal.com/...chinas-buying-to-keep-us-corn-prices...

Glufosinate Resistance Confirmed

We knew it would happen sooner or later, and

now it’s here – glufosinate (Liberty™) weed resistance in a major US broadacre

weed species. It comes as no surprise

that Palmer Amaranth is the villain.

University of Arkansas Extension weed

scientists have confirmed glufosinate resistance in a couple different Palmer

amaranth populations in the northeast part of the state. With glyphosate resistance first confirmed

about a dozen years ago in the area, many farm producers have shifted to an

over-reliance on glufosinate to control P. amaranath. Last summer, dicamba resistant P. amaranth

was confirmed just to the west of Arkansas in the neighboring state of

Tennessee.

Weed scientists in the delta region realize

the consistent battle they are involved in to effectively control weeds such as

Palmer amaranth and waterhemp. Long-term

intensive integrated management practices are being coached to area farm

managers to help extend the herbicide resource.

Outside the box tactics entail everything from cover crops to

hand-weeding to harvest weed seed control.

These management tactics are being employed to minimize the genetic

selection pressure on herbicides and to keep the weeds sensitive to remaining

control strategies.

Our more diverse crop rotations in the far

northern regions of the US do help us naturally fight the weed resistance

battle, but I’m sure we will see our battles become more intense as weeds

continue to evolve under only herbicide pressure. If you would like to evaluate some IWM

tactics this coming summer in your overall weed management program, please

contact me for a brainstorming discussion.

Being proactive today will place your farm in a good spot for the

future.

https://www.dtnpf.com/...2021/02/17/glufosinate-resistant-palmer

Enlist™ Training

For those farms with only Enlist™ soybean acres, you do not have any additional mandatory pesticide training for the winter. However, if you have liked the timely reminders on the key aspects of pesticide application, and/or see the need for some added training for your new and returning employees, here is a comprehensive online site for enhanced Enlist™ training:

https://enlist360training.bader-rutter.com/#/

Product Spotlight (2): P8431AM

The next product in our series of new Pioneer corn genetics for the spring is P8431AM. It’s medium to tall for plant height at 84 RM (relative maturity) with above average trait characteristics for brittle-snap tolerance and Goss’s Wilt.

For

a quick review, Pioneer rates their products on a 1-9 scale with 9 being the

best/strongest/tallest. Average

characteristic performance scores are rated with 4’s and 5’s; below average is

3, and above average strength would rate 6 to 7. It is fairly rare to see an advanced product

with a score of 8, but it does happen.

Most all products that would rate below a 3 on any given single

agronomic score would not make it through the process to become a commercially

available product.

Overall,

P8431AM’s strength will be yield for maturity as it is competing very well

against other hybrids in the industry for the mid-80 RM zone. We may see a bit of late season standability

issues with a root score of “4”, but late season root lodging typically only

occurs when conditions are very wet in mid-August and later (every hybrid has a

weakness somewhere). Most of the other

traits for this particular hybrid rate adequate/acceptable, so it’ll be

interesting to see how this hybrid performs across the variable conditions in

the 2021 growing season.

We’ll

have a few units of P8431AM available this spring, so please reach-out to

myself and/or your local Pioneer agent if you would like to see the hybrid on

your farm this spring.

Random

Agricultural Facts – Fertilizer History

The FarmDoc Daily out of the

University of Illinois recently had an interesting article on the history of

synthetic nitrogen in the USA. Lewis B.

Nelson also authored a book in 1990 on the topic. I don’t have a link or copy of Nelson’s book,

but here is FarmDoc’s article:

https://farmdocdaily.illinois.edu/2021/02/synthetic-nitrogen-fertilizer...

The first agriculture sales of

commercial fertilizer in the US occurred around 1840 and these specific sales

lasted for approximately 30 years. Any

guesses to the product? …Have you ever heard (or remember) the term, guano? Guano is basically bird manure and the

primary deposits of guano harvested for fertilizer supply across the world at

the time came from the west coast of South America in Peru and Chile. However, the guano was a finite supply and transporting

it in large volumes was a continuous challenge both logistically and with

concerns to human health (anyone who has ever shoveled-out a chicken coop would

know the hazard!). Other early sources

of commercial fertilizer used

globally included bones, fish scraps, slaughterhouse waste, wood ashes, sodium

nitrate, ammonium sulfate from coal gas plants, cottonseed meal, livestock

manure, and poudrette (human waste).

These various sources supplied the growing need for nitrogen fertilizer

through the early 1900’s.

In the late 19th century,

it was confirmed knowledge that the earth’s atmospheric air was largely in the

concentration of nitrogen at about 78% concentration. Also, with the very stagnant crop yields of the

time, it was forecasted/speculated that the world’s food production would not

be able to adequately meet the demand of the growing human global population at

some point in the next century. Therefore,

some leading chemists of the day in Europe were challenged to find a way to

create a nitrogen field crop fertility product by harnessing the earth’s

atmospheric nitrogen.

By 1913, two BASF chemists had standardized

the process to create anhydrous ammonia with 82% nitrogen content. The Haber-Bosch process, named after Fritz

Haber and Carl Bosch, utilizes extremely high pressure and temperature with a

metal catalyst to create the ammonia.

After cold water is used to condense the gaseous solution, the final

product is obtained as a liquid under high pressure for transportation. Once the liquid formulation losses it’s pressurized

state during application, it immediately reverts to a gaseous product and

therefore the term “ammonia gas” has been commonly used by farmers. Since the NH3 or ammonia gas is highly

attracted to water, soil moisture receives the NH3 molecule and eventually the molecule transforms slightly to become a plant available nitrogen source for uptake as

an essential macro-nutrient.

Today, the US is 4th in

the world in terms of producing nitrogen fertilizer from the process. Basically, all you need to produce the

product is a cheap energy source to create the temperature and pressures needed

to transform volumes of atmospheric air.

Other sources of nitrogen fertilizer like urea (dry solid formulation at

46% nitrogen), ammonium sulfate or AMS (dry solid formulation with 21% N and 26%

sulfur), and UAN liquid solutions (28% or 32% N concentrations), are all

created with anhydrous ammonia as the base ingredient (see chart).

Most ammonia production comes from areas with cheap and abundant natural gas available for an energy source – for the US, it’s the region of Louisiana, Texas, and Oklahoma. I would think with all the flaring of natural gas in western North Dakota, there should be some local opportunities for nitrogen fertilizer production. Maybe someday…