|

If this is actually a movie, I’d be interested in viewing it. But my guess is that the message relates to the current state of affairs with all the happenings around COVID-19, the main-stream media, and the political environment upon us. If you are like myself and many other folks I converse with, you may have found more serenity and wisdom by giving your attention elsewhere. Maybe a good book or two, an increase in family time, or some time dedicated to improving personal health/wellbeing has infiltrated more into your daily routine.

Now that most all of the crop inputs have been applied to

the corn, soybeans and spring wheat, we may find ourselves looking for wisdom

while thinking of adjustments and improvements for next year. Improving farm efficiencies in the field is

one thing, but strong farm businesses also look for ways to bolster their

operation behind the scenes… better benefit packages for their labor, analysis

improvement of their farm financials, and/or expanding their off-farm

investments to create broader diversity and risk. Whatever the goal, there are multiple ways to

achieve it.

If you are looking to improve some aspect of your operation,

Pioneer can help. We have several key

resources within the industry that can either provide the service directly, or

help you learn more broadly or specifically about a segment of the business. Please reach-out to me directly or contact

your local Pioneer sales agency for more insight.

Weather and

Corn Development

We

continue to have great conditions for the warm season crops to flourish. We’ll have moderate temperatures for the week

with small chances of precipitation. The

average temperatures will bring about 130-135 GDD’s for the week ahead.

The GDD accumulation map for our

region through the 26th of July has our corn crop in a very

favorable position as we finish-up pollination in most fields. With most locations around 100 to 200 GDD’s above

normal (1981-2010 for a 30-year average is normal for NDAWN), we are seeing

this season’s corn crop about a solid week ahead of average in general with regards

to maturity.

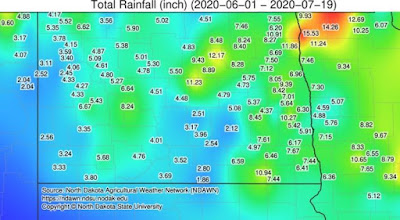

Last week may have not seemed wet

overall, but when looking across the entire seven days, we did pick-up

significant rainfall and along with the high humidity, we didn’t dry-out very

much. The corn is still consuming about 1/4

to 3/10th of an inch of water per day depending on heat, humidity

and sunshine. Hopefully, we can dry-out

some before the autumn precipitation events start.

I’ll count on your weather app

for the best guidance through the 7-8 day forecast, but looking beyond that,

I’ve found this site from NOAA to be fairly reliable for a general 8-14 day

outlook (next week).

https://www.cpc.ncep.noaa.gov/products/predictions/814day/index.php

During this time frame the

forecast is to have greater chances of being above average for temperatures,

while the precipitation forecast is for equal chances to slightly above average

chances of being wetter than normal.

The NOAA group

also provides three month outlooks. If

we would like to get a bit of insight for the autumn harvest season of Sept-Oct-Nov

time frame, it can be seen here: https://www.cpc.ncep.noaa.gov/products/predictions/long_range/seasonal.php?lead=2

This timeframe forecast

has been updated to reveal above average chances of higher temperatures, but

only equal chances of either above or below average precipitation.

The USDA estimates corn silking is occurring

across 82% of the US acreage, and at 56% for North Dakota. The prior 5-year average for corn silking

across the US is 75%, making the corn crop slightly ahead of schedule across

the nation. The corn crop condition

report states that 72% of acreage in the good to excellent category (up a tad

from last week’s 69%), and surprisingly the North Dakota crop rates at the same

level of the US crop – 72% in the good to excellent category (also up three points).

For soybeans, USDA predicts that 76% of the

acres are blooming, while 72% rate in the good to excellent category for crop

condition. North Dakota’s soybeans would

rate at 63% good to excellent and 71% are at least in the bloom stage.

Spring wheat has a 70% good to excellent

rating across the US for crop condition with N.Dakota’s spring wheat condition

rated below the national average at 64% good to excellent.

Overall, individual reports across the

country reveal a good to excellent crop coming in many/most locations. The US Drought Monitor for late July only has

some minor acreage of “Moderate Drought” throughout the major grain producing

regions.

What’s Happening in my Corn and Soybean Crops?

For

corn, I like the University of Purdue’s “Grain Fill Stages in Corn” guide. https://www.agry.purdue.edu/ext/corn/news/timeless/grainfill.html

Regardless

of corn relative maturity, it’ll take the typical corn hybrid about 60 days

from the start of silking (R1) to physiological maturity (R6) or black

layer. If we have average heat units

moving forward, we should see fully mature corn of 30-35% moisture around

September 20th to 25th – a favorable and enjoyable spot

to be.

For

soybeans, there are many resources primarily highlighting the same insight on

the reproductive stages, so I’ll just provide the following Pioneer.com site: https://www.pioneer.com/us/agronomy/staging-soybean-growth.html

Soybeans are in a unique time currently as they are still putting on vegetative growth, flowering and starting pod formation. Moisture and temperature conditions look ideal, and I look for the soybean crop to continue to improve significantly over the next couple weeks.

Product

Spotlight – Redekop®

Redekop®

has an interesting development in the area of controlling weeds at harvest

time. Unfortunately, weed resistance to

herbicides continues to plague many farms and we realize that there are not

many viable weed control options at this stage of the season and through the

end of the year. Redekop®’s thought

process revolves around the fact that many of our resistant weeds will have the

next generation of seeds passing through a combine at the end of the

season. If we can capture or destroy

these weed seeds in the harvesting process, it can go a long way to reducing

weed seedbank numbers as well as decrease our reliance exclusively to herbicides

to impact future weed numbers.

Redekop®

has a couple options available for managing weed seed numbers. Their best option for our region would to

pulverize or crush the weed seed.

Redekop®’s team has designed and built a device that mounts under the

sieve on the combine to take the chaff fraction and basically grind it to dust

before distributing it back to the field.

This method eliminates any further seasonal management, while also

maximizing efficiency and flexibility of future field operations.

Redekop®

has a couple options available for managing weed seed numbers. Their best option for our region would to

pulverize or crush the weed seed.

Redekop®’s team has designed and built a device that mounts under the

sieve on the combine to take the chaff fraction and basically grind it to dust

before distributing it back to the field.

This method eliminates any further seasonal management, while also

maximizing efficiency and flexibility of future field operations.

If

your operation is battling resistant weed populations today (like wild oats,

kochia, common ragweed, and/or waterhemp), or you would be interested in

staying ahead of the evolving weed pests, I would encourage you to view

Redekop®’s website and see how their products could impact your farm business and

prolong the viability of the herbicide resource.

https://redekopmfg.com/products/harvest-weed-seed-control/

https://www.fwi.co.uk/machinery/harvest-equipment/combines/agri...

GMO Approval Changes

from USDA

Back

in May, the USDA approved the “SECURE Rule” to minimize regulations around

Genetically Engineered (GE) technology and advances in the biotech realm. Supporters of USDA’s actions comment on the

fact that these regulations have not been significantly updated since the

science first entered the industry in the 1990’s. Opponents to the SECURE Rule, say that

biotechnology has fueled “super weeds” with herbicide resistance to significant

multiple modes of action.

My

response to those opponents would be the weeds would have continued to evolve

herbicide resistance despite glyphosate bio-tech. Maybe the spread of herbicide resistance

would have slowed, but by not approving GE crops back in the 1990’s, our weed

resistance scenario would not have been solved.

If we evaluate some of the countries that were slow to adopt GE

technology (i.e. Australia), we quickly realize they still have a growing

number of weed populations and species with resistance to glyphosate as well as

other herbicides.

Also,

now that we are at this point in history, novel new herbicide stacked GE crops

will help arm farm managers with broader tools to stay ahead of the

threat. With the painfully expensive, tedious,

and slow process of bringing new herbicide mode of actions to the market, we’ll

need GE herbicide stacked traits to maintain a handle on our resistant weeds.

Lastly,

the SECURE Rule will help aid technology like CRISPR a chance to improve nutritional

quality of food, as well as other key crop characteristics (i.e. drought

tolerance, disease tolerance, etc). So

at the end of the day, the ruling should provide more consistent food security

with everyone benefiting – the general public as food consumers, farm managers,

and the ag-industry businesses investing in GE technology.

http://news.agropages.com/News/NewsDetail---35362-e.htm

https://ghr.nlm.nih.gov/primer/genomicresearch/genomeediting

Brazil with

record Ag Exports

With

everyone keeping a close eye on the US-China trade war, Brazil placed together

a record June 2020 ag export business with sales of US$10.2 bil. The growth over June ‘19 was 24.5%.

With

the large ‘20 Brazilian soybean crop of 122 MMT (or 4.47 bil bushels), it comes

as no surprise that over 50% (actually 53.4% or US$5.42 bil) of the Brazilian June ag-export

sales were soybeans. What was the

destination of all those soybeans? Well,

it should come as no surprise the FarmDoc article states that about 70% of them

went to China. Even with the large ‘20

crop of soybeans, Brazil continues to import a few soybeans from their

neighbors to help satisfy demand.

It’s

good to see soybean demand remain high. Hopefully,

we can continue to see some strengthening US foreign relations and a weaker US dollar that will continue to help US soybeans compete on the world stage. For comparison, the May ’20 US soybean export

value was US$702 mil. Using the above

figures, the May 2020 US soybean export value was only 13% of the June 2020

Brazil soybean export value.

Disappointing, but unfortunately that’s what the numbers reveal.

https://www.statista.com/statistics/741384/soybean-production-vol...

https://farmpolicynews.illinois.edu/2020/07/brazilian-agribusiness...

https://www.ers.usda.gov/data-products/foreign-agricultural-trade...

Brazil

Facing Scrutiny over Illegal Deforestation

An interesting report came out of Science magazine about Brazil and their

agriculture production from illegally deforested lands. You wouldn’t think that there would be much

ramification for illegally deforesting land, but the EU is raising criticism as

they have a pending trade agreement with Mercusor (the South American trading

bloc of Brazil, Argentina, Uruguay, and Paraguay).

The trade agreement between the two bloc’s do contain environmental

protections and the EU is threatening not to ratify the pending agreement due

to Brazil’s lack of commitment to an environmental agenda.

The recently completed study estimates that only 2% of the rural

Brazilian farms accounted for 60% of the detected illegal deforestation. There is no mention on acreage that is

influenced, however the illegal deforestation accounted for 17% of meat and 20%

of the soybeans that were exported to the EU.

If these are the estimated volumes of export to the EU, I wonder how

much of Brazil’s soybeans exported to China came from illegally deforested

lands? Maybe this will funnel more EU

soybean purchases from the US.

https://science.sciencemag.org/content/369/6501/246

https://farmpolicynews.illinois.edu/2020/07/science-magazine-study...

Random

Agricultural Facts – US and Canada 2020 Plantings

We’ve all heard the term “corn is king” which comes from

maize dominating US farm acre production for decades. But, what is the “king” of crops in our neighboring

country to the north?

If you count spring wheat, winter wheat and durum wheat

together as “all-wheat”, that total acreage in Canada would add-up to 25.0 mil

acres. Spring wheat dominates the

“all-wheat” category with 17.9 mil acres, with durum a distant second at 5.7

mil acres. If we brake-up the wheat

category, canola would be king at 20.8 mil acres. After “all-wheat”, canola, and barley, soybeans

would come in at a distant fourth at 5.1 mil acres. If you are wondering about Canadian corn

acreage, it would arrive in 8th place (after field peas, lentils,

and oats) at 3.6 mil acres. All numbers

are based on 2020 Canadian June preliminary estimates for planting of principle

field crops.

It’s interesting to note that Canada has only 78.5 mil acres

of principle crops… heck, over the last several years, the US often plants more

total soybean acres than that!

https://www150.statcan.gc.ca/n1/daily-quotidien/.../t001c-eng.htm

For the USA in 2020, corn is king at 92.0 mil acres, soybeans

follow at 83.8 mil acres, and all-wheat (winter, spring and durum) at 44.25 mil

acres would round out the top three crops in terms of acres planted across the

US. But, are there any guesses to the

fourth most crop planted in the US?

For crops, cotton probably would qualify as 4th

at 12.1 mil acres forecasted for 2020 planting.

Alfalfa as hay would be in the discussion as well at 16.4 mil

acres. Other hay – which could include a

variety of forage crops – would account for 36.0 mil acres, making all hay at a

total acreage of 52.4 mil acres (more than all-wheat).

After hops (fifth at 7.5 mil acres) and sorghum (sixth at

5.6 mil acres), the remaining crops barely make-up 14 mil acres of US plantings

in 2020. For the beer lover, it’s

interesting to note that hops acreage is about 2.7 times the size of the barley

acres (7.5 mil vs 2.8 mil).

Principle crop acreage in the US accounts for 311.9 mil

acres in 2020; almost four times the Canadian principle crop acreage.

For a source on these US ag stats, or to review the June

2020 USDA plantings report, click on this link: https://downloads.usda.library.cornell.edu/usda-esmis/files/j098zb09z/vx022244t/8910kf38j/acrg0620.pdf